- /

- Blog

Best 10 AI Tools for Financial Service Professionals

But here’s the challenge: with AI flooding the marketplace, not all AI is built for finance work.

Most tools automate around the process. A smaller set automates inside the workflow. And an even smaller group now introduces agentic AI - capable of taking multi-step actions on your behalf, with full auditability and human control.

This guide covers the top 10 tools leading this change.

What “AI Tooling” Really Means for Finance Teams

AI tooling refers to software that automates, analyzes, or enhances financial workflows using machine learning, natural language understanding, or agentic reasoning.

For finance teams, this means:

- eliminating manual data entry

- accelerating reconciliations

- improving internal controls

- surfacing risks earlier

- enabling quicker month-end and year-end closes

- strengthening documentation for audit and regulatory review

The right tools turn hours of manual work into minutes — without sacrificing accuracy or control.

Why AI Adoption Is Accelerating in Financial Services

Across banks, insurers, fintechs, asset managers, and corporate finance teams, three pressures keep coming up:

1. More work with fewer people

Talent shortages are real. Teams need automation that removes the grunt work so they can focus on analysis and decisions.

2. Rising regulatory complexity (SOX, ESG, IFRS/GAAP changes)

Every new reporting requirement increases the documentation burden — making AI-powered evidence gathering and review essential.

3. Higher accuracy expectations

Manual processes introduce inconsistency and risk. AI helps teams strengthen accuracy and audit trails while speeding up workflows.

Here are the top AI tools to consider as FinServ professionals

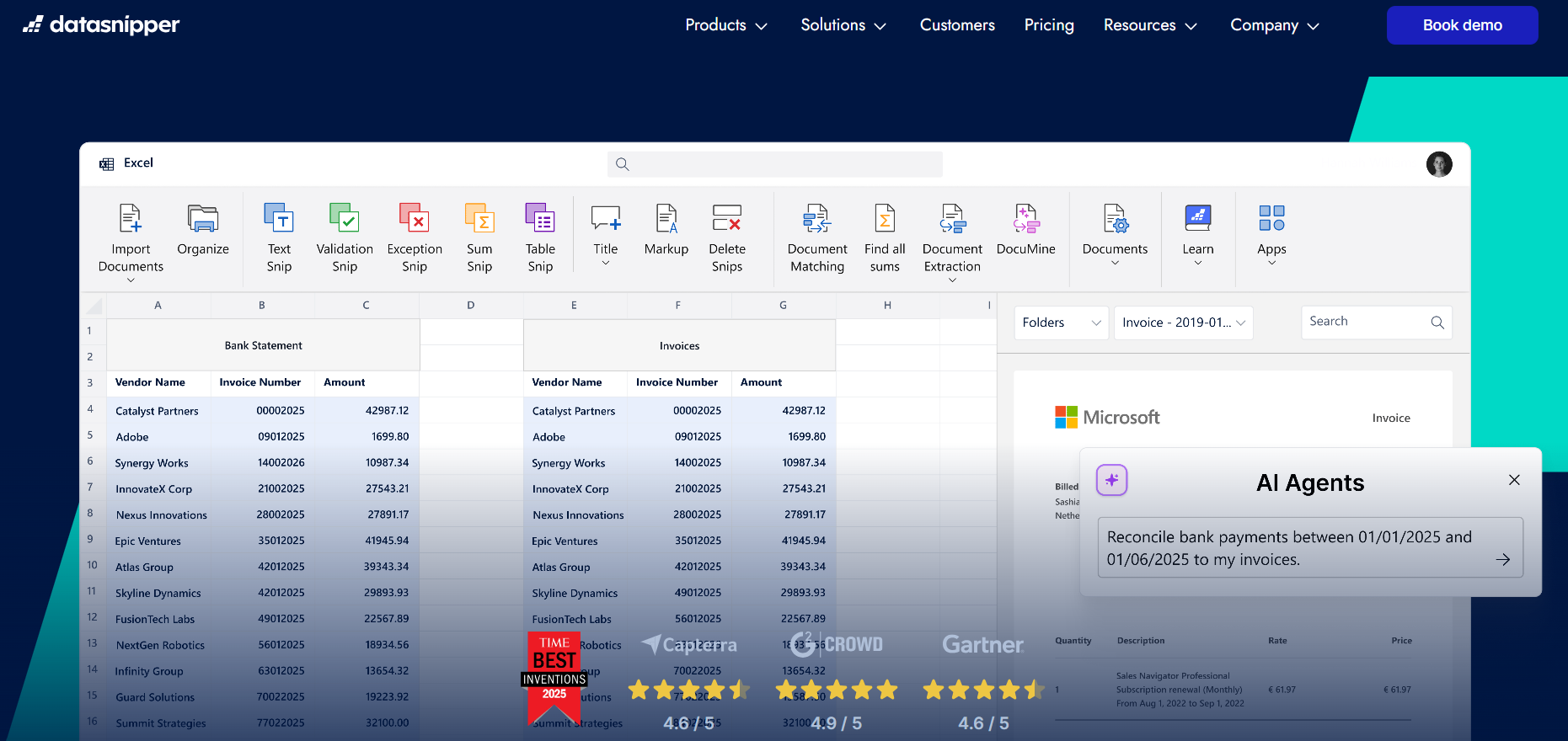

1. DataSnipper

Website: www.datasnipper.com

Finance use cases:

• Automated testing & reconciliations: Match invoices, statements, and contracts to your Excel schedules in seconds — with full traceability.

• AI-powered document review: Extract answers from policies, contracts, and supporting documents instantly.

• Smarter disclosure reviews with Disclosure Agents: Automatically compare your financial statements against IFRS and GAAP requirements, flag missing disclosures, and generate audit-ready documentation.

• Accelerated close & compliance workflows: Quickly gather evidence for financial reporting, ESG, and SOX controls, with every step documented.

• Multi-step automation inside Excel with Excel Agents: Use agentic AI to perform sampling, recalculations, tie-outs, or validations directly in Excel — keeping you in control while AI handles the busywork.

Standout features:

- Excel-native automation — no new platforms or interfaces to learn.

- Scalable Snip-matching engine for structured and unstructured data, with full audit-ready traceability.

- TIME's Best Invention DocuMine AI for automated, source-linked document review across contracts, policies, and supporting evidence.

- Disclosure Agents for AI-assisted IFRS/GAAP compliance reviews, linking every requirement to the right evidence.

- Excel Agents for agentic, multi-step testing directly inside Excel.

- Trusted by 600,000+ professionals, enterprise-secure, and available via Microsoft AppSource.

See DataSnipper in action:

2. Workiva

Website: https://www.workiva.com

What it does: A cloud-based platform for regulatory, SOX, ESG, audit, and financial reporting, now enriched with generative AI to draft narratives and automate controls.

Finance use cases:

• Streamline SOX testing and controls documentation: auto-generate updates, PBC requests, and working paper links.

• Automate ESG disclosures with standardized tagging, workflow collaboration, and full audit trails.

Standout features:

• GenAI assistant pulls context directly from your documents.

• Built-in compliance controls, linking narrative and numbers with audit-ready traceability.

3. MindBridge

Website: https://www.mindbridge.ai

What it does: An anomaly-detection and risk scoring platform that analyzes 100% of transactions, spotting fraud, errors, and inefficiencies using AI.

Finance use cases:

• Highlight high-risk journal entries before audit fieldwork.

• Monitor ongoing financial activity to detect fraud, internal control issues, or compliance risk.

Standout features:

• Real-time AI scoring with dashboarded visualization and anomaly explanation.

• Integrates with Microsoft Fabric for seamless data workflows.

4. Datarails

Website: https://www.datarails.com

What it does: An FP&A platform built on Excel that automates data consolidation, forecasting, budgeting, and real-time reporting, with AI-powered Q&A chat capabilities.

Finance use cases:

• Centralize and auto-refresh budgets and forecasts.

• Run “what‑if” scenarios and visualize impact across departments.

Standout features:

• Maintains Excel workflows with added version control and collaboration.

• Fast setup (often within two weeks), with strong support from finance-obsessed onboarding teams.

5. Cube

Website: https://www.cubesoftware.com

What it does: A collaborative FP&A tool that connects spreadsheets with ERPs, supports continuous planning, scenario modeling, and natural-language queries.

Finance use cases:

• Run rolling forecasts that automatically adapt to live data.

• Ask questions in plain English (or Slack/Microsoft Teams) and get charts or insights back.

Standout features:

• Easy integration with Excel and Google Sheets.

• Built-in forecasting and AI coaching to help users interpret data without complex formulas.

6. Ramp

Website: https://www.ramp.com

What it does: An AI-first expense, bill-pay, and corporate card solution that automates spend capture, policy enforcement, and reconciliation.

Finance use cases:

• Auto-capture receipts and match them to expenses.

• Detect out-of-policy purchases, duplicate charges, or unused subscriptions.

Standout features:

• 24/7 policy enforcement, set granular merchant/cap limits and auto-lock cards.

• Transparency via real-time spend intelligence and alerts to control overspend.

7. Brex

Website: https://www.brex.com

What it does: A modern corporate card platform with AI tools for spending insights, real-time budget compliance, and virtual card management.

Finance use cases:

• Issue virtual cards tied to budgets, real-time policy checks, and real-time tracking.

• Enforce budgets and prevent overspending before it happens.

Standout features:

• AI assistant flags anomalies, suggests optimization steps.

• High limits without personal guarantees and top-tier mobile experience.

8. Validis

Website: https://www.validis.com

What it does: A cloud data-extraction tool that connects to client accounting systems like Xero and QuickBooks – extracting full or selective financial data with encryption and standardization.

Finance use cases:

• Quickly gather GL, P&L, AR/AP data across multiple clients or entities.

• Prep clean data sets for audits, analytics, or covenant compliance.

Standout features:

• Choice of full or selective extraction of financial history.

• Secure, scalable portal backed by audit-grade encryption, used by 90% of its customers.

9. Power BI with Copilot

Website: https://powerbi.microsoft.com

What it does: BI dashboarding enhanced by Copilot’s generative AI – allowing finance teams to ask questions, generate insights, and summarize findings in natural language.

Finance use cases:

• Build interactive dashboards that update automatically with live financial feeds.

• Ask natural-language queries like “show revenue variance by region” and get charts or commentary back instantly.

Standout features:

• Deep integration with Excel and Microsoft ecosystem.

Copilot accelerates analysis and helps non-technical users surface insights.

10. Alteryx

Website: https://www.alteryx.com

What it does: A no-code analytics platform that automates data prep, blending, and modeling – ideal for mega spreadsheets and cross-system workflows.

Finance use cases:

• Clean and combine financial data from multiple systems – e.g., ERP, GL, transaction logs.

• Automate reconciliation and report preparation ahead of close.

Standout features:

• Drag‑and‑drop workflow builder minimizes reliance on IT.

• Powerful scalability, designed for complex, high-volume use cases.

Choosing the Right AI Finance Tools for Your Team

We’re riding the AI wave to maximize efficiency, and as finance professionals, staying ahead means embracing these tools – they’re quickly becoming a must. For FinServ professionals, the right tools can eliminate hours of manual work, surface risks earlier, and keep you compliant without slowing things down for you or your team.

If you’re just starting your journey in AI tools for FinServ, the most important thing is to pick tools that fit your workflows, integrate easily, and deliver immediate value.

Want a deeper look at how these tools compare? Download our Buyer’s Guide to AI in Finance.

Frequently asked questions

What are the best AI tools for financial services in 2025?

Top AI finance tools include DataSnipper, Workiva, MindBridge, Datarails, Cube, Ramp, Brex, Validis, Power BI with Copilot, and Alteryx. Each supports different needs - from automation and anomaly detection to spend management and ESG reporting.

How is AI used in financial services?

AI is used to automate routine tasks, detect fraud, forecast trends, manage compliance, and streamline reporting. It helps teams move faster, stay accurate, and reduce manual work.

What is DataSnipper used for in finance?

DataSnipper is primarily used to automate evidence gathering, audit testing, and reconciliation workflows directly in Excel. It’s especially helpful for documenting internal controls and preparing ESG or regulatory reports.

Is DataSnipper available in Excel?

Yes. DataSnipper is an Excel add-in, designed to work inside the environment finance and audit teams already use.

Is DataSnipper Agentic AI secure?

How does Agentic AI work inside DataSnipper?

Agents understand your prompt, analyze the workbook, take the required steps (testing, matching, reviewing, extracting), and produce audit-ready outputs with traceable evidence links - all within Excel.

.png)

.png?width=600&quality=70&format=auto&crop=16%3A9)

.png?width=600&quality=70&format=auto&crop=16%3A9)