- /

- Blog

Achieving Financial Transparency: The Role of Trial Balance Reconciliation

What is Financial Transparency?

When a company practices transparent financial reporting, it builds trust among all the folks involved, helping them make better decisions about investing or partnering up.

In today's hectic business world, where companies are all over the globe and have different people involved, financial transparency is incredibly important for how a company is run. It's the foundation that keeps financial information legitimate and trustworthy.

Being financially transparent means the company shares all the necessary financial details with everyone who matters, like shareholders, investors, employees, and the authorities. This info could be things like financial statements, annual reports, tax stuff, and other money-related disclosures.

And it's not just about throwing numbers around; it's about making sure the information is easy to understand. Financial reports should be done in a way that follows the accounting rules, so everyone can compare and figure them out without headaches.

The Basics of Trial Balance Reconciliation

During this reconciliation process, auditors carefully review each account to make sure the debit and credit entries match up correctly. It's like tidying up the financial records to keep them neat and precise.

When the debits and credits match perfectly, the auditors can confidently prepare accurate financial statements.

Moreover, trial balance reconciliation isn't just about numbers; auditors meticulously analyze the figures, looking for any errors or signs of potential fraud. It's all about ensuring transparency, accountability, and the financial well-being of the organization.

The Link Between Trial Balance Reconciliation and Financial Transparency

Trial balance reconciliation plays a vital role in achieving financial transparency. It's all about making sure everything adds up correctly. By reconciling the balances of all accounts, organizations can ensure that their financial statements are accurate, reliable, and don't have any major mistakes.

Without proper reconciliation, financial statements might end up with errors or irregularities, and that could seriously mislead stakeholders and damage the company's credibility.

So, it's essential to reconcile the trial balance to maintain the integrity and transparency of the financial information that's presented to investors, creditors, and other stakeholders. Keeping things straight and honest is the way to go.

Best Practices for Trial Balance Reconciliation

While trial balance reconciliation is an indispensable process, it is vital to follow best practices to ensure effectiveness and efficiency.

- Establish a Standardized Reconciliation Process: Define clear roles and responsibilities, ensure separation of duties, and implement a robust review and approval mechanism.

- Regular and Timely Reconciliation: Perform monthly or quarterly reconciliations to promptly identify and address errors, ensuring accurate and reliable financial information for decision-making and reporting.

- Regular Training and Skill Development: Invest in training and skill development for the finance team to ensure they are equipped with the necessary knowledge and expertise to perform effective reconciliations.

- Automating Reconciliation Processes: Wherever possible, use automation tools and software to streamline the reconciliation process. Automated reconciliations can reduce manual errors, increase efficiency, and free up resources for other critical tasks.

Challenges and Pitfalls in Manual Trial Balance Reconciliation

- Time-Consuming and Labor-Intensive Process: Manual trial balance reconciliation can be a time-consuming and labor-intensive task, impacting overall productivity.

- Increased Risk of Human Error: Handling large volumes of data and complex spreadsheets manually increases the likelihood of human errors, affecting the accuracy of reconciliation.

- Difficulty in Tracking and Documenting Changes: Keeping track of changes made during manual reconciliation becomes challenging, leading to potential confusion and verification issues.

- Limited Efficiency and Scalability: Manual reconciliation may work for small organizations but becomes less efficient and scalable as businesses grow.

- Higher Risk of Overlooking Errors and Discrepancies: Manual reconciliation poses a higher risk of overlooking errors or discrepancies in the data, potentially leading to financial discrepancies and compliance problems.

Enhancing Financial Transparency with Reconciliation Automation

To tackle the challenges of manual trial balance reconciliation and improve financial transparency, many organizations are turning to reconciliation automation.

Reconciliation automation involves using intelligent technology to streamline and optimize the reconciliation process. By eliminating the need for manual data entry and calculations, it significantly reduces the risk of errors and boosts accuracy.

Automation also provides better collaboration opportunities, enabling auditors to track changes and document the entire process efficiently. This frees up valuable time that can be redirected towards analyzing and interpreting financial data, thereby adding substantial value to the organization.

The Role of Auditors in Promoting Financial Transparency

Auditors are essential for promoting financial transparency through trial balance reconciliation. Besides handling the technical aspects of reconciling accounts, they are trusted advisors who safeguard the integrity of financial information.

By following best practices, using automation tools, and staying updated with regulatory requirements, auditors ensure accurate and transparent financial reporting. Their expertise and attention to detail are crucial in maintaining stakeholders' trust and confidence in the organization.

With their dedication, businesses can confidently make informed decisions and show their commitment to financial responsibility. auditors play a vital role in keeping things running smoothly and ensuring that the numbers add up.

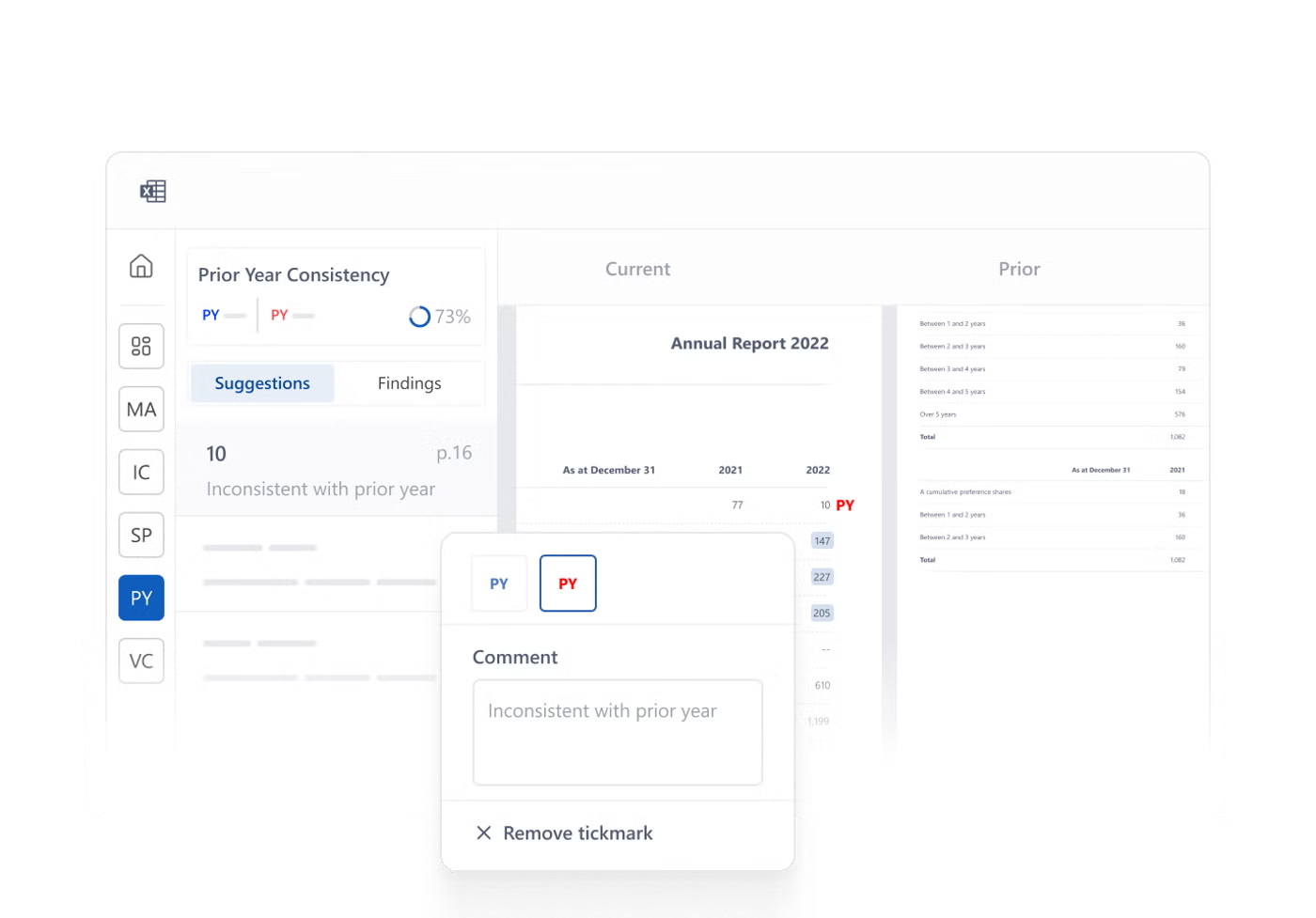

DataSnipper and Trial Balance Reconciliation

Audit work is typically performed and scoped based on Trial Balance data. However, the sign-off is on the financial statements. This means that a reconciliation between these two sources is almost always required.

That’s where DataSnipper steps in. Auditors using DataSnipper:

- Extract the Trial Balance data into a usable format utilizing the table snip function.

- Create a pivot table in Excel to summarize.

- Then use Document Matching to reconcile the summarized Trial Balance data in the financial statements and ensure that the balance included in the final financial statements is accurate per the trial balance.

Curious to see this in action? Check out our Use Case video below.

.png?width=600&quality=70&format=auto&crop=16%3A9)

.png?width=600&quality=70&format=auto&crop=16%3A9)